Best Bang for Your Buck When Buying a Used Car

New Car Buying Guide

How to Maximize Savings While Reducing Time and Hassle

1. The Basics

Car Shopping is consistently rated as one of the worst experiences. And I can certainly relate to that. The main reason I started Real Car Tips was due to the terrible feeling I experienced after purchasing my first new car. I had no idea if I had negotiated a good deal or got ripped off.

After tons of research, I finally realized why: The vehicle franchise laws in this country are totally outdated. It's against the law to purchase a new car anywhere other than through a franchised car dealership. That means new cars cannot be sold directly through the manufacturer, or any other entity for that matter. And yes, that includes online car buying services - all of which require you to complete the transaction with a dealer.

The laws go back decades - long before the Internet was around, and they've stayed this way due to heavy lobbying efforts by dealers. The sytem creates exclusive territories for dealers and a strong incentive for high-pressure sales, which results in a terrible car buying experience.

It doesn't look like the laws will change anytime soon. However, the good news is the system has some major holes, and it's possible to take advantage of them. It's not unheard of to save $5,000 or more, plus a lot of time and hassle, simply by following these proven car buying strategies.

![]()

The Ultimate New Car Buying Method

The Ultimate New Car Buying Method

This is my step-by-step negotiation method that will squeeze every last penny of savings out of your new car purchase. I've included email and phone templates, so all you have to do is follow directions.

2. Budget: How Much Can You Afford?

Today's average new car sells for about $30,000 - and that's before factoring in taxes, fees, insurance, and other expenses.

I know it's boring to talk about budgeting, but you really need to do this BEFORE you start shopping. Most people overestimate how much car they can afford, which leads to uncomfortably high payments. Buying a new car should be a pleasent experience, not one that makes you worry about finances.

If possible, you should pay cash to avoid interest payments - but don't let dealers know since they prefer buyers who finance. Those who need a car loan should follow these guidelines:

- Monthly payments should be no more than 15% of your take-home pay (that's after taxes)

- Limit car loans to 48 months or less

- Down payment should be at least 20% of the purchase price

If you can't hit these budget targets, you really need to consider buying a lower-priced car. Try looking at used cars or spend a few months saving up for a larger down payment. It's much better to be safe than sorry when it comes to budgeting for a car.

3. Choosing a Car

I didn't create this site to help you choose a car - there's lots of other sites that do a good job with that. My mission is to help you save money, period. I don't care what car you choose; I just want to help you get the best deal.

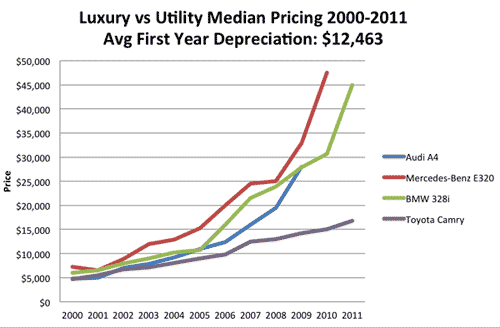

It surprises many that the price of a car doesn't necessarily determine how much it costs. If you buy an expensive car that depreciates slowly, it may end up costing less over the long-term than if you purchased a lower-priced one that loses value quickly.

Depreciation makes up the bulk of a vehicle's cost, so you need to pay close attention to this. If you spend $30,000 on a car, you essentially have a depreciating asset. You can sell the car at any time and get some money back, but the depreciation is your actual cost - money you'll never get back. Luxury vehicles in particular tend to depreciate the quickest, as can be seen from the chart below:

If you have your heart set on a luxury vehicle, it really makes sense to purchase a slightly used model, saving you thousands of dollars in depreciation.

Being flexible with your vehicle choices allows you to shop for the best deals. Many shoppers have their heart set on one specific model and refuse to even test drive the competition - this is a huge mistake. One of the best pieces of advice I can give you is this: go out and test drive as many competing vehicles as you can. I promise you will be surprised by the results. Cars that you never thought you would like suddenly become attractive once you're behind the wheel, while others you thought were awesome turn out to be ho-hum.

Don't just trust the reviews you find online, everyone has their own opinion when it comes to cars. Most of the car sites and magazines are geared toward auto enthusiasts - those who are more interested in performance than everyday driving and reliability.

4. Buying Options

In recent years, car manufacturers have been disciplined when it comes to production. They no longer overproduce, which used to lead to large incentives to help sell the excess inventory.

It was normal to have 60 to 90 days worth of inventory available on dealer lots, but now it's more like 30 to 60 days for most vehicles, and some of the hot sellers are down to single digits. Car shoppers are finding it more difficult to locate vehicles with the exact colors and options they desire.

If you're having problems locating the vehicle of your choice, you have two options: You can special order a vehicle from the factory to your exact specifications, or you can expand your search to dealers located further away (sometimes hundreds of miles away). Buying a one-way plane ticket to pick up and drive your car home is something that should be considered if the deal is exceptional.

Locating your car is one thing - getting a great deal is another. In recent years, several companies have made it more convenient and pleasant to buy a new car. You still have to ultimately complete the transaction with a dealer, but most of these car buying services now provide pre-negotiated prices, TrueCar.com and RydeShopper being the two that I highly recommend.

![]()

TrueCar

Works with a network of over 9,000 dealers who have agreed to offer pre-negotiated pricing. The deals are usually very good.

RydeShopper

Also works with thousands of dealers to offer upfront, discounted price quotes on new vehicles.

5. Negotiation Tactics

Now we get to the juicy part - how do you negotiate the best deal possible? The answer may surprise you: Don't negotiate! That's right, it sounds counter-intuitive, but to get the best deal on a new car, all you need to do is follow some simple directions.

Most car shoppers do everything the wrong way. They think negotiating face-to-face with a car salesman is the way to go - but you should NEVER set foot in a dealership when negotiating. Instead, get pricing via phone or email only.

Watch this short video of Bruce Bueno de Mesquita, author of The Predictioneer's Game, talking about the optimal method to getting the lowest price on a new car. I love the way he sums up the process in a simple to understand way.

That's really all there is to it. It's a matter of following directions and gathering prices, rather than actual negotiation. I provide more detailed instructions including email and phone templates in my step-by-step car buying guide. For those who want to take advantage of this process without having to spend lots of time gathering prices, here are the services I recommend.

Other negotiation tips: Always negotiate everything separately. Dealers love to combine your trade-in with the price of the new car - it creates price confusion and makes it hard to compare deals. Same goes for financing or add-ons such as extended warranties - shop around for the best deals. And NEVER negotiate based on monthly payments.

6. Car Prices and Fees

Some car buyers are completely clueless. They don't realize you can negotiate the price of a new car! Obviously, car dealers love them, but it brings up a good point: Just how much wiggle room is there on price?

I've found that most new cars can be negotiated 5% to 15% below MSRP, although I've seen discounts as much as 35% on leftover models after incentives are factored in. There are also some vehicles that are in high demand, and they actually end up selling for above MSRP (but that usually lasts for only a few months at most).

There are three prices you should be familiar with:

- MSRP - only suckers pay this

- Invoice Price - the "wholesale" price, what the dealer supposedly paid for the vehicle

- Dealer Cost - the true price paid by the dealer

So why isn't invoice price what the dealer truly paid? Because there's a lot of hidden incentives and kickbacks that dealers receive whenever they sell a new car. These include dealer holdback, stair-step incentives, credit vouchers, and dealer cash-back programs provided by the manufacturer. In some cases, a dealer's true cost can be thousands of dollars below invoice price.

There's really no way to know for sure what a dealer's true cost is - only the dealer knows that. But you need not even worry about this because as long as you use my car buying method, you'll automatically get these hidden kickbacks passed onto you through a discounted purchase price - it's an elegant system that pretty much guarantees the lowest price.

7. Car Incentives

Car incentives are a way for manufacturers to help move slow-selling models.

Most people are familiar with cash-back incentives - that's where you get a manufacturer discount when buying a specific model. They usually range between $500 and $5,000. But there's also all kinds of bonus cash, lease deals, financing incentives, and loyalty programs available - it's tough keeping up with all of them.

What most people don't know is that manufacturers also give incentives to dealers, in the form of hidden kickbacks and other credits. This is especially true on leftover models or ones that are selling very poorly.

Incentives are a closely guarded secret - not even dealers know what the manufacturers will provide in coming months. It all depends on the market and how well the vehicles are selling compared to the competition. Usually, incentives will start out small in the beginning of the year and gradually increase as the year unfolds. The largest incentives are given towards the very end of the year.

Incentives are great when you're buying a new car, but they do come with a downside. Too many incentives will lead to a drop in resale values. Manufacturers that limit incentives usually have vehicles that don't depreciate as quickly.

8. Leftover Vehicles

Manufacturers usually do their model year changeovers between August and November, but I've seen them do it as early as January. The rule is: they can release next year's models beginning on January 1. It can get confusing, but that's just how the industry works.

A vehicle is considered a leftover when the next year's models start showing up on dealer lots. It doesn't matter if the leftovers are still current-year vehicles.

Manufacturers start getting worried whenever too many leftovers pile up on the lots and end up competing with the new ones. Dealers need to make room for all the new inventory, so manufacturers tend to bump up incentives on the leftover models, especially towards the end of the year.

Does it pay to wait and buy a leftover model? It depends - sometimes dealers are able to sell the leftovers with ease; other times, they get desperate and are forced to slash prices. Usually, it's the latter, so in most cases, a leftover model should save you money.

However, you should be prepared to keep the vehicle for many years, so the depreciation doesn't outweigh the savings. A leftover is technically considered a one-year-old vehicle when you purchase, even if it's a current year model. Also, keep in mind the longer you wait to buy one, the more likely you'll get a better deal - but, you're also less likely to get the colors and options you desire. Leftovers are always part of a diminishing supply, so keep a close eye on the market to help you decide when to purchase.

9. Timing Your Purchase

Did you know you can save money by timing your car purchase? Dealerships and salespeople are pressured to sell more vehicles during certain periods, so catching them during these times will give you maximum negotiation leverage.

For example, each dealership will have monthly sales goals. Manufacturers ofentimes offer bonuses for each vehicle a dealer sells above a certain threshold. When it comes down to those final days each month, the pressure is on to meet the quotas. Therefore, the final few days of each month present a great car buying opportunity.

The best time of year is said to be the week between Christmas and New Year. Most people aren't shopping for cars during this time, and every dealer is frantically trying to meet end-of-year sales goals and bonuses. Manufacturers tend to offer the largest rebates just before the end of the year to clear out all remaining models and add incremental sales to their yearly total.

Sometimes you get lucky and two competing manufacturers are nearly tied for sales that year, as happened with BMW and Mercedes in recent years. The incentives were higher than normal as both companies tried to win the sales crown for the year.

10. Legal and Paperwork

It's funny how dealers seem to "make errors" when it comes to the final paperwork. How convenient that nearly all the mistakes happen to favor the dealer!

Obviously, these aren't mistakes, but rather a way for shady dealers to literally steal your money. The only way to protect yourself is to look through the final documents with an eagle eye.

DO NOT skimp out on this. Take your time reviewing all the numbers and don't be afraid to question everything. If you do run into problems - even after signing the documents, many dealers will rectify the situation when you contact them (but they will play it off as a "mistake").

If things can't be settled, you do have a few options. The one thing dealers fear most is when customers file complaints with the State Attorney General. Hopefully, you won't need to resort to this - and in most cases you shouldn't have to if the dealer is smart.

Best Bang for Your Buck When Buying a Used Car

Source: https://www.realcartips.com/newcars/